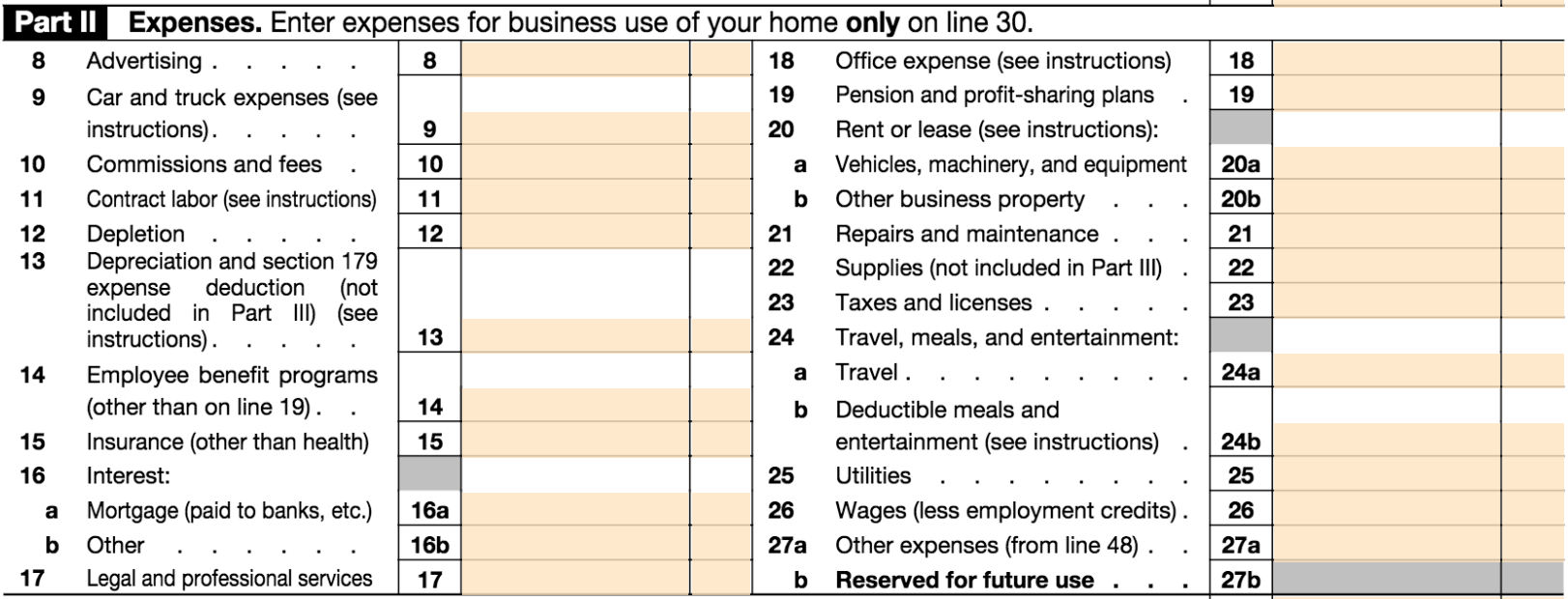

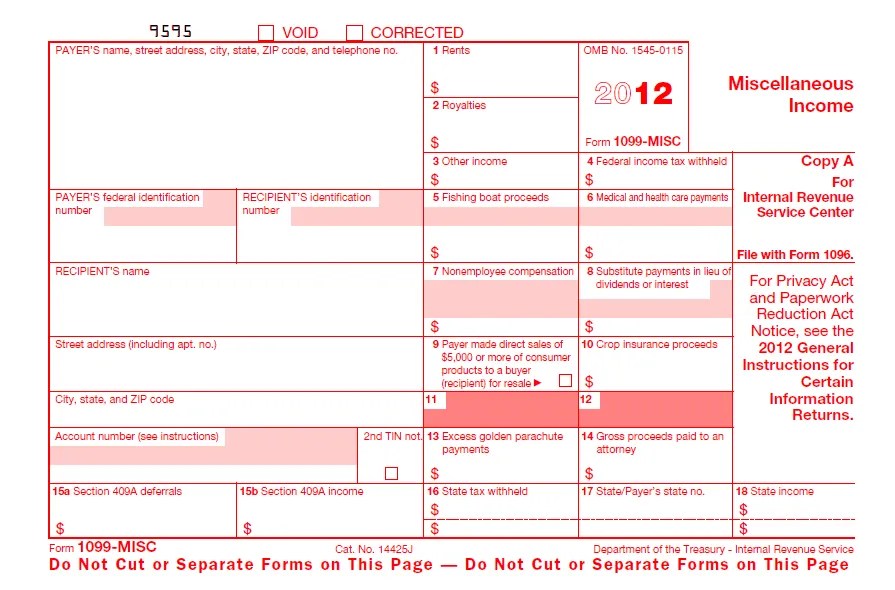

So, educational expenses are potentially suitable as a tax break for the self-employed or independent contractor tax deduction.įor example, virtual conferences, webinars, business-related books, subscriptions to professional publications are all eligible as deductibles when filing taxes. Educational expensesįor growing a business, pursuing courses and skill development sessions might be an essential factor. So, here we have tried compiling a list of independent contractor tax deductions or self-employed write-offs, whatever you prefer to call them! 1. In other words, independent contractors are responsible for their freelancer tax deductions.įortunately, 1099 employees can claim several tax deductions. Tax deductions for independent contractorsĪs we have already mentioned that, unlike employees, 1099 employee tax deductions are self-managed. This form will be applicable if an independent contractor plans to list out the qualifying dependents. If an independent contractor is claiming earned income tax credit, it will be mandatory to fill out Schedule EIC. In the case of claiming tax credits, using Form 1040 is a must. But if independent contractors want to itemize deductions, Form 1040 and Schedule A need to be filled out. Forms Requiredįor independent contractor tax deductions, they can claim the standard deduction on Form 1040. Plus, tax credits can also be claimed even if the independent contractor has no tax liability. The main benefit of tax credits is reducing the amount paid in taxes or increase a refund. This includes self-employed write-off expenses like healthcare, tuition, or any other capital gains losses faced. Tax deductions offset the amount of income on which independent contractors are to pay their taxes. Likewise, there are non-refundable tax credits as well. In certain cases, like earned income tax credit, it might increase the refund or provide a refund even if no taxes are owed. On the other hand, tax credits are directly reduced from the amount of taxes owed. Tax deductions are calculated as percentages of the income taxes owed, which reduces the amount of taxes payable. Then, the tax burden will be reduced to $5000. For example, an independent contractor qualifies for a $1000 tax credit and owes $6000 as a tax amount. The higher the tax amount, the more the benefits of tax deductions.Ĭoming to a tax credit, it is a dollar-for-dollar reduction in the tax amount that is owed. For example, if the independent contractor is in the 10% tax bracket and the tax deduction is $4000, the deduction would reduce the taxes by $400. Independent contractors minus the independent contractor tax deductions from their income before calculating the taxes owed. In other words, tax deductions result in the lesser amount payable as income taxes. DefinitionĪ tax deduction reduces the amount of income taxes payable. There are several differences between tax credits and tax deductions. But before that, let’s have a look at the differences between tax deductions and tax credits. Later in the article, we have listed the top tax breaks for self-employed that you can’t miss out on. This means that independent contractors can deduct the most appropriate and relevant 1099 business expenses on their tax returns. So, the IRS considers independent contractors as a business.

Independent contractors are self-employed, nothing less than a small business.

1099 CONTRACTOR EXPENSES UPDATE

So, read on to update yourself on independent contractor deductions if you plan to hire one soon! How do Tax Deductions Work when You’re Self-employed? In this blog, we’ll walk you through independent contractor tax deductions in detail. We mean that the independent contractors manage their taxes. Unlike employees whose taxes are deducted automatically from their monthly compensations, employers do not handle independent contractor deductions.ġ099 employee tax deductions are self-handled. In the case of employees and freelancers, tax deductions are different. As a business, you ought to know how the independent contractor tax deductions work.

0 kommentar(er)

0 kommentar(er)